ID :

641806

Wed, 09/21/2022 - 14:57

Auther :

Shortlink :

https://oananews.org//node/641806

The shortlink copeid

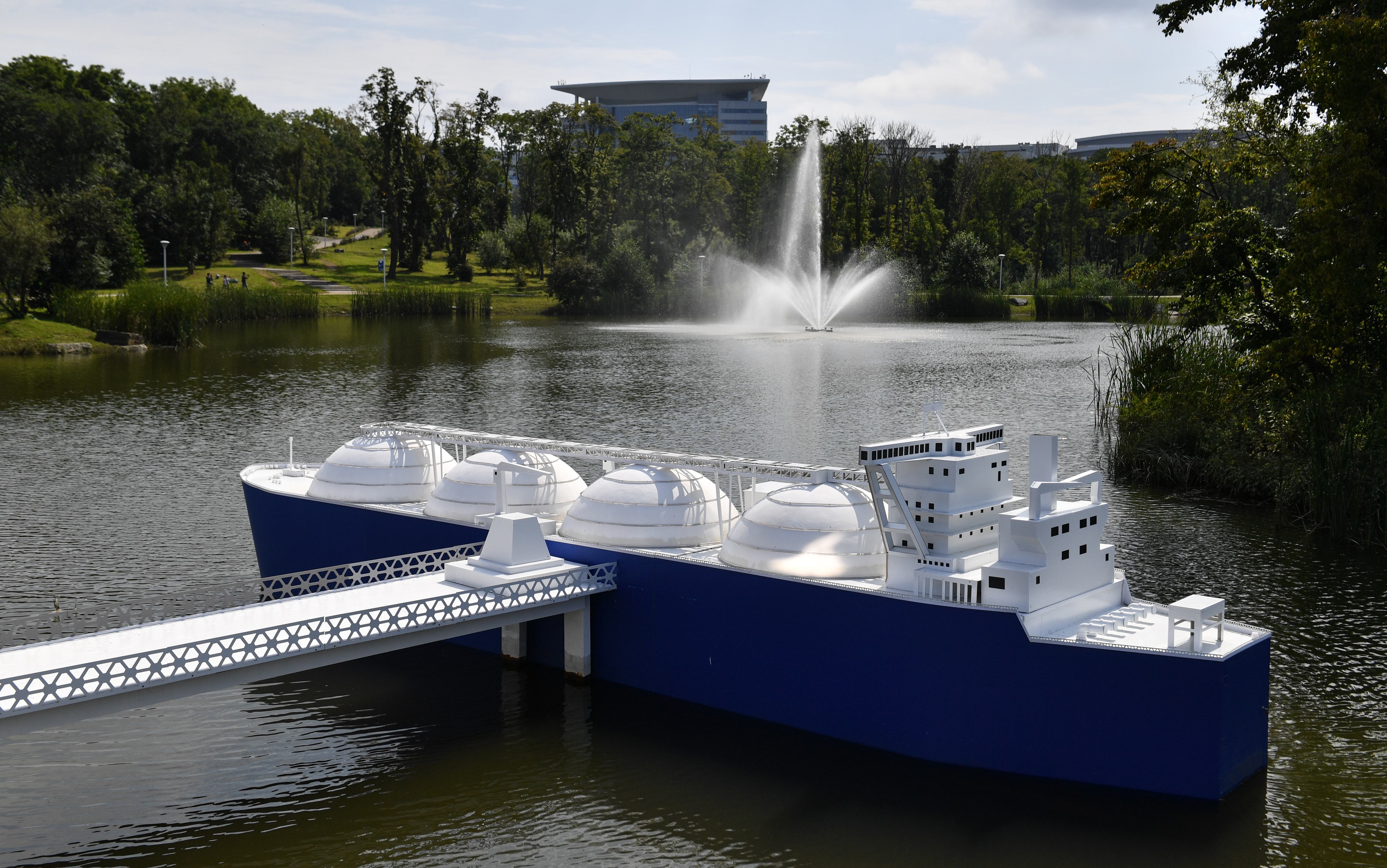

China's Russian LNG Import Value Tripled in 2022 as Beijing Acts as Middleman to Sanctioning Nations

Since the start of 2022, China has signed major deals with Russia, Saudi Arabia, and others to dramatically increase its importing and processing of petroleum products, including crude oil and liquefied natural gas (LNG), as well as coal.

According to newly released customs data, China increased its LNG imports from only two countries so far in 2022 - Qatar and Russia, the latter of which nearly tripled from 2021 numbers. At the same time, China’s LNG exports have increased, in part to offset the economic effects of Omicron-driven lockdowns.

According to the South China Morning Post (SCMP), which viewed the data, the value of LNG coming to China from Russia via pipelines in the first eight months of 2022 was nearly triple that seen in the previous year, amounting to $2.39 billion. In terms of volume, China’s overall LNG imports from Russia increased by 28.5% year-on-year; for imports from Qatar, they increased by 66.7%, or two-thirds.

Those trends are in keeping with the close partnership between Moscow and Beijing that has blossomed in recent years, and China’s refusal to abide by Western demands that it join their attempts to isolate Russia politically and economically following the launch of its special operation in Ukraine. Instead, Beijing has asserted its neutrality on the subject, calling for a peaceful settlement of the issues between Kiev and Moscow while acknowledging NATO’s role in provoking the conflict.

Western sanctions combined with shipping disruptions caused by the conflict dramatically increased the price of petroleum products, including crude oil and LNG, in the weeks following the Ukraine operation’s launch in late February. After Russia, the world’s largest exporter of such products, began offering discounts to major buyers like China and India, their purchases increased drastically, more than offsetting the temporary damage done by Russia losing its European customers.

China has faced its own economic troubles in 2022 as it struggles to keep a lid on COVID-19 outbreaks as part of its “Dynamic Zero Covid” policy, which has spared it the mass death seen in most other nations. The lockdowns have interrupted trade, hurting businesses, so Beijing was forced to scale back plans to divest from cheap fossil fuels in order to keep its economy afloat. European nations and the US have made similar adjustments.

With LNG market prices still so high, Beijing has seized the opportunity to buy up cheaper Russian gas and sell it abroad, helping to offset some of the lockdown-induced economic damage. Ironically, many of its buyers have been European nations that imposed sanctions on Russia in the first place.

According to Nikkei Asia, China’s JOVO Group, Sinopec Group, Dongguan Jovo, and other LNG sellers had sold European buyers roughly 4 million tons of LNG between January 1 and July 1, or roughly 7% of Europe’s LNG imports in that time. According to the Tokyo-based outlet, their collective profits could exceed $100 million.

Earlier this month, Russia’s Gazprom said it had reached a deal with National Petroleum Corporation (CNPC) for gas pipeline sales to be settled in rubles and renminbi, helping to fuel talk of a “petro-Yuan” to rival the “petrodollar” that has dominated international markets since the mid-20th century.

Read more: https://sputniknews.com/20220920/chinas-russian-lng-import-value-tripled-in-2022-as-beijing-acts-as-middleman-to-sanctioning-nations-1101019991.html