ID :

233105

Fri, 03/16/2012 - 11:10

Auther :

Shortlink :

https://www.oananews.org/index.php//node/233105

The shortlink copeid

India Budget: Additional taxes to net USD 8.3 billion; defence gets USD 38.7 bn

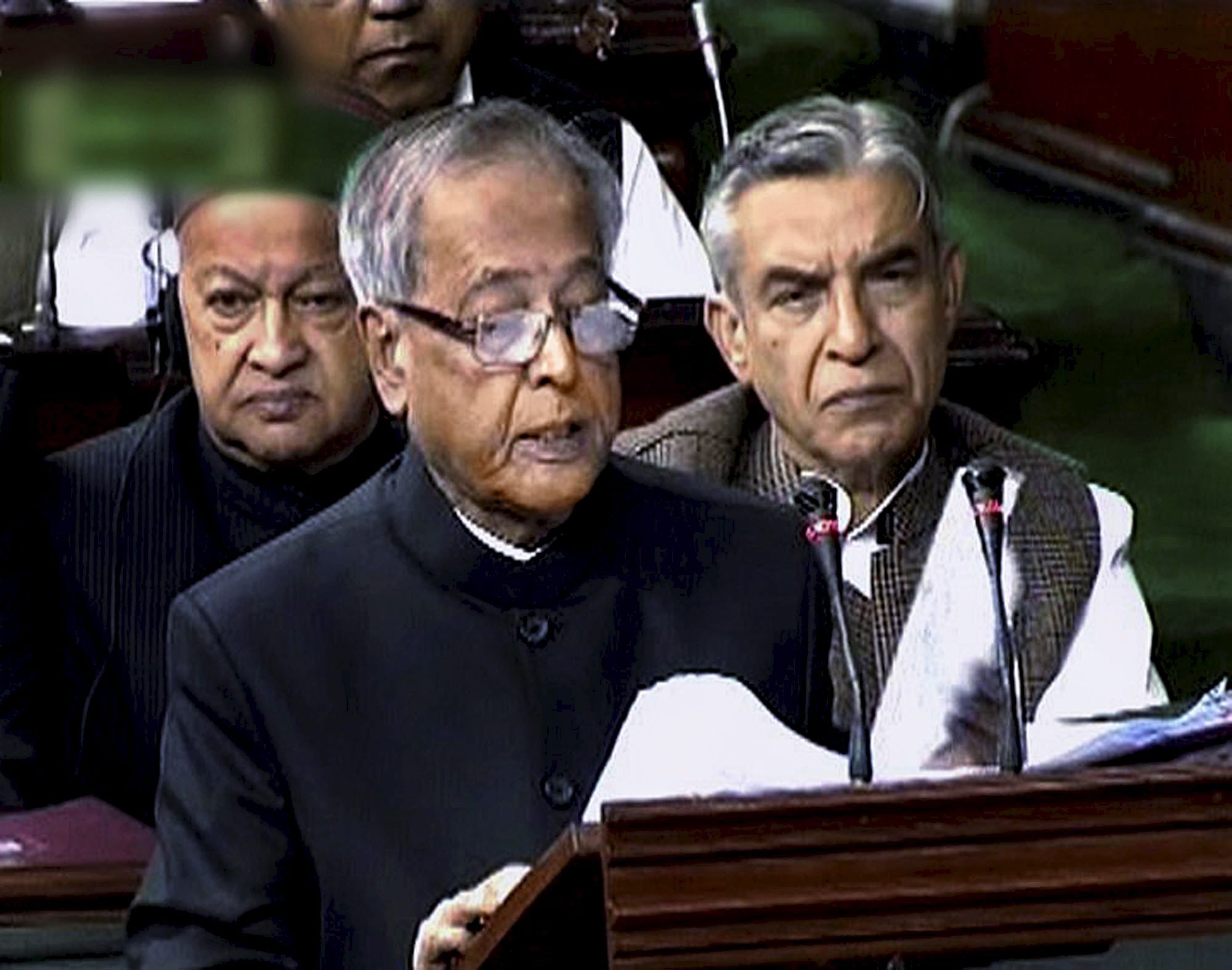

New Delhi, Mar 16 (PTI) In a mix of sops and imposts, the General Budget of the Indian Government today proposed a marginal raise in individual income tax exemption limit but hiked service tax and standard excise duty by 2 per cent across the board to net an additional Rupees 414.4 billion (about USD 8.3 billion) a year.

The Budget for 2012-13 presented by India's Finance Minister Pranab Mukherjee in the Lok Sabha, lower house of Parliament, however, left corporate tax rate and peak customs duty unchanged while the import duty on gold bars and platinum and excise duty on cigarettes, bidis, pan masala and chewing tobacco were raised.

Customs duty on completely built large cars, SUVs and MUVs of value exceeding USD 40,000 was also raised.

While the direct tax proposals in the Budget will result in a revenue loss of Rs 45.0 billion (about USD 900 million), indirect tax proposals would result in a revenue gain of Rs 459.4 billion (about USD 9.2 billion). Thus the tax proposals lead to a net gain of Rs 414.4 billion (about USD 8.3 billion).

The Budget makes a provision of Rs 1,934.07 billion (about USD 38.7 bn) for defence services.

Under the budget proposals, individual income up to Rs 200,000 will be free from income tax as against Rs 180,000 at present. Income between Rs 200,000 and 500,000 will be taxed at 10 per cent while that above Rs 500,000 but less than Rs 1.0 million would attract 20 per cent, and above Rs 1.0 million it would be 30 per cent. The 30 per cent tax slab is at present applicable for income beyond Rs 800,000.

Noting that the share of service taxes remains far below its potential, the Budget proposed to tax all services except those in a negative list of 17 heads. The important inclusions in the negative list comprise all services provided by government and local authorities except a few services where they compete with the private sector. The negative list also include pre-school and school education, recognised education at higher level and approved vocational education, renting of residential dwellings, entertainment and amusement services and large part of public transportation including inland waterways, urban railways and metered cabs.

In addition to the negative list, there is a list of exemptions which include health care, services provided by charities, religious persons, sportspersons, folk and classical artists, individual advocate providing services to non-business entities, independent journalists, animal care and car parking.

Service tax proposals are expected to yield an additional revenue of Rs 186.6 billion (about USD 3.7 bn).

Proposing a fiscal correction that would result in higher prices across-the-board, the Budget has proposed to raise the standard rate of excise duty on non-petroleum products from 10 to 12 per cent. In the wake of global financial crisis in 2008-09 it had been reduced from 14 to 8 per cent but raised to 10 per cent in 2010.

Large cars currently attract excise duty depending on their engine capacity and length. In keeping with the increase proposed in the standard rate, the Budget now enhances the duty from 20 to 22 per cent.

No change is proposed in the peak rate of customs duty of 10 per cent on non-agriculture goods. Barring a few individual items, the rates below the peak are also being retained.

The Budget fully exempted branded silver jewellery from excise duty. Unbranded precious metal jewellery will attract excise duty on lines of branded jewellery.

Customs duty has been raised for gold bars and coins of certain categories, platinum and gold ore. Customs duty is also to be imposed on coloured gem stones.

The proposals relating to customs and central excise are estimated to net a revenue gain of Rs 272.8 billion (nearly USD 5.5 billion) in a full year.

The Budget identified five objectives to be addressed effectively in the coming fiscal year beginning April 1, 2012. These will include focus on domestic demand driven growth recovery, create conditions for revival of high growth in private investment, address supply bottlenecks in agriculture, energy and transport sectors and intervene decisively to address the problem of malnutrition in 200 high burden districts.

The Budget also intends to address the problem of blackmoney and corruption in public life. A white paper on blackmoney will be placed in Parliament during the current session.

India government's gross tax receipts for 2012-13 are estimated at Rs 10,776.12 billion (about USD 215.5 bn), an increase of 15.6 per cent over budget estimates and 19.5 per cent over the revised estimates for 2011-12.

Total expenditure for 2012-13 is budgeted at Rs 14,909.25 billion (about USD 298 bn), of which Plan expenditure is Rs 5,210.25 billion (about USD 104 bn) and non-Plan Rs 9,699.0 billion (about USD 194.0 bn).

The combined effect of lower tax and disinvestment receipts and higher expenditure, mainly on account of subsidies, has pushed the fiscal deficit to 5.9 per cent of GDP in the revised estimates for current fiscal.

However, the Finance Minister said, he has made a determined attempt to come back to the path of fiscal consolidation in the Budget for 2012-13 by pegging the fiscal deficit at Rs 5,135.9 billion (nearly USD 102.8 bn), which is 5.1 per cent of the GDP.

After taking into account other items of financing, the net market borrowings through dated securities to finance this deficit is Rs 4,790.0 billion (about USD 98.0 bn).

With this total debt stock at the end of 2012-13 would work out at 45.5 per cent of the GDP. The effective revenue deficit in Budget estimates 2012-13 works out to Rs 1,857.52 billion (about USD 37.15 bn) which is 1.8 per cent of the GDP. PTI