ID :

620563

Thu, 01/27/2022 - 00:34

Auther :

Shortlink :

https://www.oananews.org//node/620563

The shortlink copeid

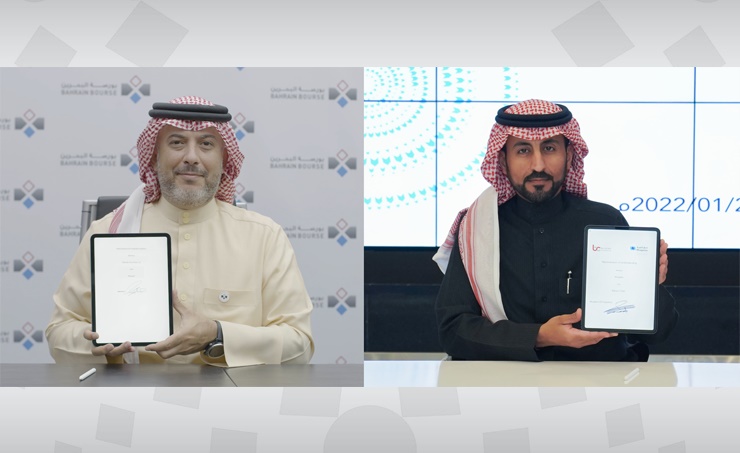

Bahrain Clear Signs MoU with Securities Clearing Center Company (Muqassa)

Manama, Jan. 26 (BNA): Bahrain Clear, a fully owned subsidiary of Bahrain Bourse, has signed a Memorandum of Understanding (MoU) with Muqassa, the Securities Clearing Center Company in Saudi Arabia fully owned by the Saudi Tadawul Group. The agreement was signed by Shaikh Khalifa bin Ebrahim Al-Khalifa, Vice Chairman and Managing Director of Bahrain Clear and Wael Al-Hazzani, CEO of Muqassa.

The MoU seeks to foster the exchange of information and experiences in order to develop central clearing in both countries, as well as to explore collaboration opportunities concerning central clearing development and training services.

Shaikh Khalifa bin Ebrahim Al-Khalifa, Vice Chairman and Managing Director of Bahrain Clear, commented on the occasion: “This MoU clearly defines the goal and purpose of our collaboration and establishes a formal channel of information exchanges, broadening the cooperative area in terms of business development and innovation. The MoU will encourage initiatives for further practical cooperation, resulting in significant benefits for both exchanges, including efficiency resulting in enhanced liquidity.”

“We look forward to working with Muqassa to strengthen cross-border connectivity and financial ecosystems in Bahrain and Saudi Arabia, further intensifying the strong bilateral ties between both Kingdoms,” Shaikh Khalifa added.

Wael Al Hazzani, CEO of Muqassa stated, ‘’Bahrain Clear and Muqassa share the privilege of satisfying our respective capital markets industries, and we both acknowledge the significance of that role, which prompted the start of our collaborative efforts. This MoU is a true testament to our mutual dedication to promote a fair and competitive trading environment. In addition, this agreement establishes a foundation for effective cooperation between the Muqassa and Bahrain Clear to explore training opportunities and various areas of development in securities depository with the aim of creating new opportunities to achieve mutual benefits for both parties and fulfil the objectives of the MoU.”

It is worth noting that the MoU is in line with the GCC countries’ joint efforts to strengthen the link between systems and institutions in the capital markets sector.

Bahrain Clear was established in June 2017 as a clearing house licensed by Central Bank of Bahrain. Bahrain Clear is a fully owned subsidiary of Bahrain Bourse with a disclosed capital of 5 million Dinars, and a paid up capital of 1 million Dinars. Bahrain Clear offers pre and post trade services to investors as well as a range of services including transactions depository, clearing, settlement, central registry and registration.

The Securities Clearing Center Company (Muqassa) was established in 2018 as a closed joint stock company fully owned by Saudi Tadawul Group, with a capital of (SAR 600,000,000). Muqassa will contribute to reduce Post-Trade risks, provide centralized counterparty risk management, and develop clearing services in accordance with international practices to align with advanced global capital markets, which in turn will attract investors to the market.